It sounds like the issue here in the original post has been identified. The test booking being made was using a bogus credit card - and since we do some validatation on the credit card number - the booking was getting kicked-back.

There was a GREAT suggestion to highlight this better - the way Webervations is doing it isn't as clear/obvious as it could be. We put it in as a high priority to improve this hopefully to avoid confusion.

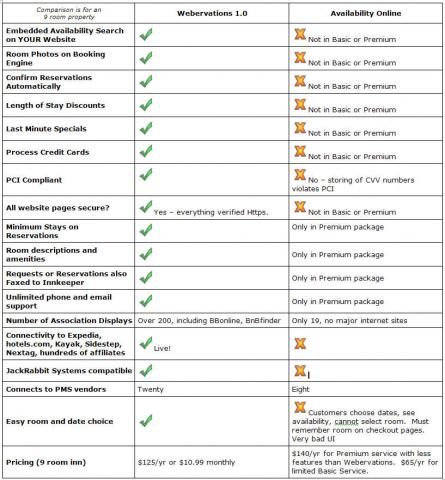

I've heard AO is coming out with some changes. We'll certainly update this when that is the case - I think competition is great for the industry. We've learned a lot about some useful features from competitors of ours, and I'm sure they learn the same from us. Incidentally - I was curious if Availability Online validates the credit card info - so I tested a property. They do not - so any random number will work. Could be something that is being pdated/changed, but another difference to add to the list.

While testing that - for all of you concerned with credit card security - the CVV code on AO is redisplayed as actual text right online on the confirmation screen - again a huge no-no for PCI rules that ultimately properties will be held liable for. I don't mean to go on a witch hunt - but this is something that innkeepers should really be aware of. I certainly would not want to take on that type of liability. This is directly from the PCI website and affects the merchant of record in any data breach (the property):

>Q: What are the penalties for noncompliance?

>A: The payment brands may, at their discretion, fine an acquiring bank $5,000 to $100,000 per month for PCI compliance violations. The banks will most likely pass this fine on downstream till it eventually hits the merchant. Furthermore, the bank will also most likely either terminate your relationship or increase transaction fees. Penalties are not openly discussed nor widely publicized, but they can catastrophic to a small business.

It is important to be familiar with your merchant account agreement, which should outline your exposure.

http://www.practicalecommerce.com/articles/717-Merchants-Liable-For-Data-Breaches

Here is a great article on the impact this can have for small businesses. Mind you - most of these business were using a 3rd party system that they didn't realize was storing sensitive information - yet the small business gets the fine, not the 3rd party...

http://online.wsj.com/article/SB119042666704635941.html?mod=sphere_ts.